r&d tax credit calculator 2019

114-113 made the RD tax credit permanent and added a provision permitting eligible startup companies. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022.

Income Tax Calculator Calculate Income Tax Online For Ay 2022 23 Fy 2021 22

The credit benefits companies of any size in every industry and yet people leave the money on the table.

. A to Z Constructions average QREs for the past three years would. Calculate your potential RD tax credit savings using TaxTakers simple ROI calculator Calculate your potential RD tax credit savings using TaxTakers simple ROI calculator. Home RD Tax Credits Calculator.

A tax credit generally reduces the amount of tax owed or increases a tax refund. Revenue guidelines update 2019 In March 2019 Revenue published updated guidelines for the RD tax credit Tax and Duty Manual Part 29-02-03 superseding the April. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Enter Current Year Total Wages Average Annual Growth over prior 3 years Projected net federal credit. The results from our RD Tax Credit Calculator are only estimated figures and actual numbers will vary depending on the specific circumstances of the business. Easy Fast Secure.

Plus it carries forward 20 years. For startups applying the credit against payroll taxes is a valuable non-dilutive funding opportunity. The rate of relief is 25.

The Kruze Consulting RD Tax Credit Calculator is designed to estimate your RD tax credit using. Let our experts research and provide information that you need to understand how this credit can genuinely benefit your business. It should not be used as a basis for calculations submitted in your tax returns.

According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in. The RD tax credit is a tax incentive in the form of a tax credit for US. If you would like a detailed analysis of the potential benefits or.

So if your RD spend last year was 100000 you could get a 25000 reduction in your tax bill. Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief. We have created a quiz to help you get a head start on.

Max refund is guaranteed and 100 accurate. The RD tax credit is now permanent and for the first time ever small businesses and start-ups can take advantage of this lucrative tax credit. 97 affected the credit by significantly reducing the corporate tax rate and repealing the corporate alternative minimum tax.

Get a detailed RD calculations to your inbox. Subtract the Result Once we determine the total well take that number and subtract it from the current years QRE. This is a dollar-for-dollar credit against taxes owed.

The IRS uses a four-part test to determine if a business activity meets the standard of qualified research. According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion for corporations and 12 billion for individuals. Complete IRS Tax Forms Online or Print Government Tax Documents.

Multiply the Number Once we get the total for your research expenses well multiply the number by 50. 4 The RD tax credit was first established in 1981 in the Economic Recovery Tax Act ERTA. Call us at 208 252-5444.

Select either an SME or Large company. Tax credits calculator - GOVUK. If youre a loss-making business youll receive your RD tax credit in cash because you dont have a tax liability to offset.

Companies to increase spending on research and development in the US. And we do not want to stop here without helping you. Ad Do Your 2020 2019 2018 2017 Taxes in Mins Past Tax Free to Try.

Start Your Tax Return Today. For most companies the credit is worth 7-10 of qualified research expenses. This credit appears in the Internal Revenue Code section 41 and is earmarked for businesses that have costs related to research and development.

Free means free and IRS e-file is included. Ad All Major Tax Situations Are Supported for Free. One of our RD experts will contact you right away to begin the process of.

Estimate your tax savings using our quick simple RD Payroll Tax Credit Calculator then contact us using the form above. The Tax Credit Calculator is indicative only and for information purposes. Use our simple calculator to see if you qualify for the RD tax credit and if so by how much.

In 2021 alone alliantgroup delivered over 23 billion in credits and incentives to over 14000 businesses. RD Tax Credit Calculator. Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator.

Just follow the simple steps below. This calculator has been developed utilizing data from a variety of studies conducted in the industries listed. This is only an approximation based on a variety of assumptions and should be treated as such.

The RD Tax Credit is an incentive credit for entrepreneurs under section 41 of the Internal Revenue Code that is headed as 26 US. What expenses qualify for the research and development tax credit. The Protecting Americans From Tax Hikes Act of 2015 PATH PL.

The Kruze Consulting RD Tax Credit Calculator is designed to estimate your RD tax credit using. Supports Profit and Loss making companies. Get a free estimate of the RD tax credits your company is eligible for.

RD Tax Credit Calculator. Get Started Now Qualified Expenses. W2 wages for technical staff.

We will show you how. Without this information you wont be able to claim the tax credit. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

RD Tax Credit Calculator. Code 41 Credit for increasing research activities Under this provision of law a portion of the expenditure incurred by the taxpayer in carrying on research R D. And so the RD tax credit has been revised to give more instant gratification.

Rd report for Based on the information you provided it looks like we could help you claim back up to for. RD tax credits generated in 2017 can be used to offset payroll taxes come mid-2018 and RD tax credits generated in 2018 can be used to reduce payroll taxes in 2019. Calculate RD tax relief in under 3 minutes.

Estimate RD tax relief for your business. Contact Strike to know exactly how much you stand to. And so the RD tax credit has been revised to give more instant gratification.

RD tax credits generated in 2017 can be used to offset payroll taxes come mid-2018 and RD tax credits generated in 2018 can be used to reduce payroll taxes in 2019. RD Tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes. Guidance on this can be found on our Which RD scheme is right for my company page.

RD Tax Credits Calculator. The RD tax credit calculation can be done under the regular research credit method or the alternative simplified credit. Across all sectors the average amount reclaimed for our clients is 50000.

Select whether the company is profitable or loss making. For example software companies that invest in their technology. For profit-making businesses RD tax credits reduce your Corporation Tax bill.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Dutch Tax Credits Benefits Tax Breaks In The Netherlands

Easy Solar Tax Credit Calculator 2021

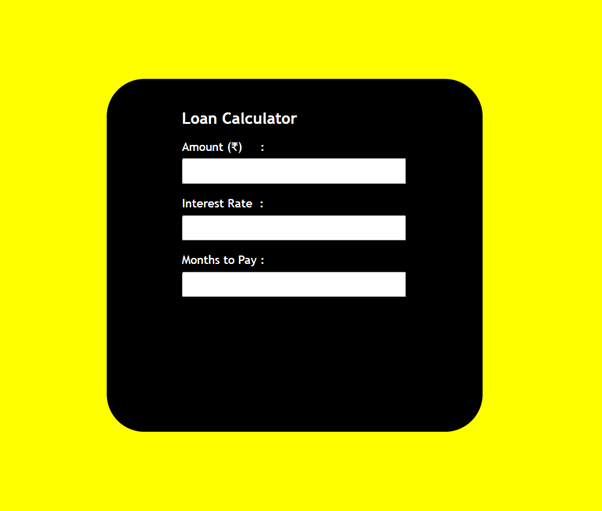

Loan Calculator That Creates Date Accurate Payment Schedules

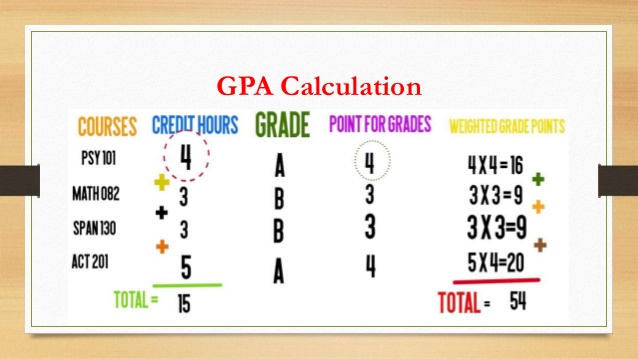

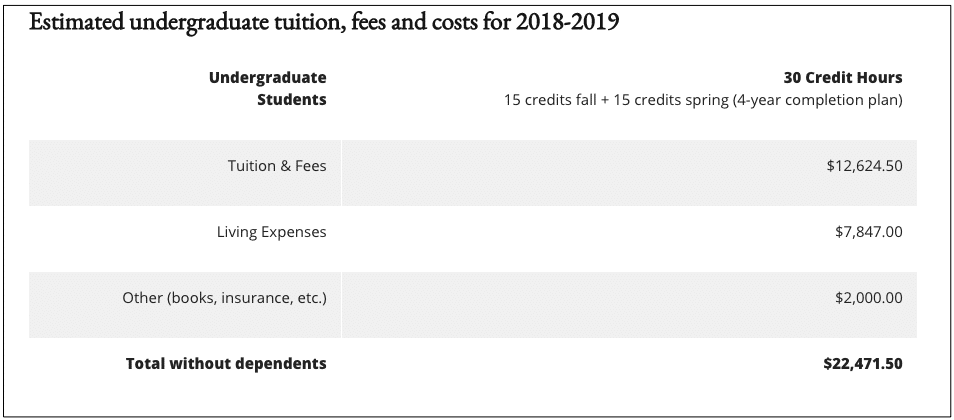

Credit Hour Calculator Credit Calculators

Preimplantation Genetic Testing Pgt Market Genetic Testing Chromosomal Abnormalities Genetics

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

Business Woman Using Calculator And Laptop For Do Math Finance On Wooden Desk In Office And Bookkeeping Services Accounting Services Digital Marketing Services

R D Tax Credit Calculation Adp

Pearson Edexcel Gcse In Mathematics November 2021 Latest Complete Marking Scheme Download For Higher Grades

R D Tax Credit How Your Work Qualifies Alliantgroup

Design A Loan Calculator Using Javascript Geeksforgeeks

What S Your Credit Score Federal Credit Union Credit Score Student Login

Credit Hour Calculator Credit Calculators

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Mortgage Calculator With Down Payment Dates And Points

How To Calculate Value At Risk Var In Excel

Download Adoption Tax Credit Calculator Excel Template Exceldatapro Tax Credits Excel Templates Federal Income Tax