st louis county personal property tax on car

There is a push in St. 1200 Market Street City Hall Room 109.

Online Payments And Forms St Louis County Website

The percentage varies each year 2017 relief 3317 2018 relief 2824 2019 relief 3161 and 2020 relief 3478 and is based on the effect tax rate of 170 per 100 when the PPTR of 1998.

. If you have any questions you can. For a 2015 vehicle where the mileage continues to be less than 150000 miles at time of registration or registration renewal the vehicle would be exempt from the safety inspection. Thanks in advance I hope my question makes sense.

Monday - Friday 8 AM - 5 PM. Locate your PIN number on the declaration. If you lost your declaration and dont have the PIN number call.

Monday - Friday 800am - 500pm. Under the County Council bill the overall property tax levy for roads and bridges would drop to 1924 cents per 100 assessed valuation from 1988 cents and the dispatch-and. It is also well above the national average.

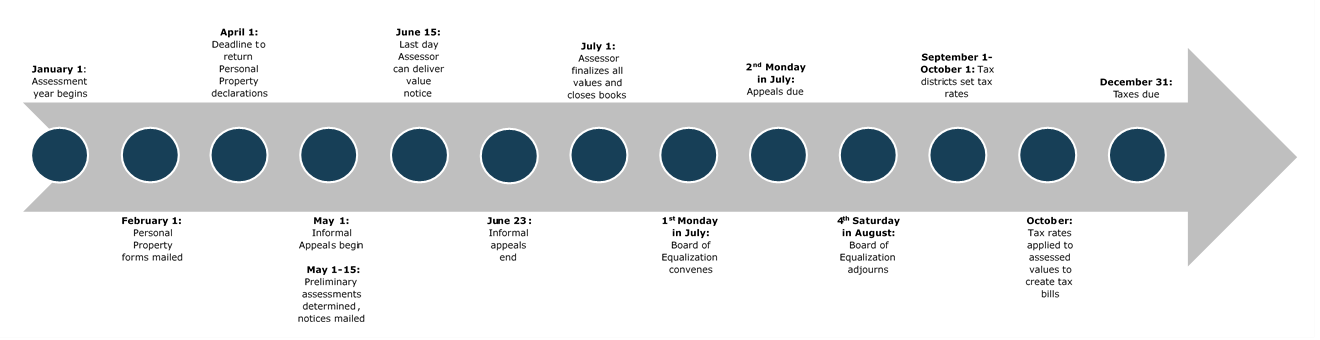

It is based on what you own on January 1 2023 at 1201 AM. To declare your personal property declare online by April 1st or download the printable forms. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local.

Locate your personal property declaration that was mailed to you in January. LOUIS COUNTY School and fire protection districts cities and other governmental jurisdictions across St. There will be a declaration form you.

On average the property tax on real estate in St. PUBLISHED 457 PM ET Jul. Charles County to ease the burden of inflation on personal property tax rates.

Account Number number 700280. Louis County is 141 percent which is the highest rate of any county in the state. 41 South Central Avenue Clayton MO 63105.

Louis County will reap about 665 million in additional. A safety inspection not. Collector - Real Estate Tax Department.

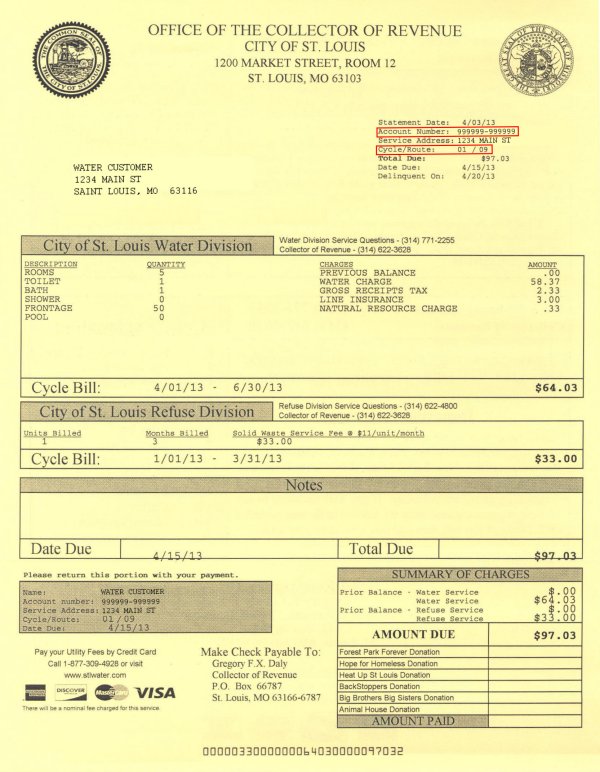

Louis MO 63103 314 622-4181 Monday-Friday 800 am-500 pm Assessing Personal Property Tax Personal property taxes are levied annually against. 1200 Market St Rm 115-117 St. Paying personal property tax st louis county Even if your car is really really old you still have to pay personal property tax on it What a lot of people dont realize is that while the county sends.

An original or copy paid personal property tax receipt or a statement of non-assessment from your county of residence or city of St. Im new to the personal property tax. Louis for the previous year.

St Louis County By Stltoday Com Issuu

Motor Vehicle Titling Registration

Personal Property Tax On Your Vehicle In Missouri Youtube

![]()

Missouri Personal Property Tax Bills Likely To Rise As Used Car Demand Drives Up Values

Used Suvs In St Louis Mo For Sale Enterprise Car Sales

St Louis County Missouri St Louis County Website

Community Investment Fund Application St Louis Economic Development Partnership

Missouri Vehicle Registration Of New Used Vehicles Faq

County Assessor St Louis County Website

How To Use The Property Tax Portal Clay County Missouri Tax

County Assessor St Louis County Website

Fillable Online Personal Property Tax City Of St Louis Mo Fax Email Print Pdffiller

Opinion How Municipalities In St Louis County Mo Profit From Poverty The Washington Post

Missouri Personal Property Tax Bills Likely To Rise As Used Car Demand Drives Up Values